Nvidia (NVDA), the leading maker of graphics processing units (GPUs) and artificial intelligence (AI) chips, has seen its shares surge by 24% on Wednesday, adding nearly $200 billion to its market value.

The stock closed at a record high of $389.46, bringing its market cap to $960 billion, just shy of the coveted $1 trillion mark.

The catalyst for the massive rally was Nvidia’s stellar earnings report for the fourth quarter of fiscal 2023, which ended on January 29.

- The company reported revenue of $6.05 billion, up 50% year-over-year and beating analysts’ expectations of $5.41 billion.

- The company also posted earnings per share of $2.31, up 64% year-over-year and surpassing analysts’ estimates of $1.51.

The impressive results were driven by strong demand for Nvidia’s products across all segments, especially data centers and gaming.

- Data center revenue, which includes sales of GPUs and AI chips for cloud computing, artificial intelligence, and high-performance computing, soared by 97% year-over-year to $2.91 billion, accounting for nearly half of Nvidia’s total revenue.

- Gaming revenue, which includes sales of GPUs for PC and console gaming, as well as cloud gaming services, jumped by 67% year-over-year to $2.5 billion, fueled by the launch of new GeForce RTX 30 series GPUs and the popularity of GeForce NOW streaming service.

Nvidia also issued a bullish outlook for the first quarter of fiscal 2024, projecting revenue of $6.3 billion, plus or minus 2%, which would represent a 72% year-over-year growth and a 4% sequential increase.

Analysts were expecting revenue of $5.25 billion for the quarter.

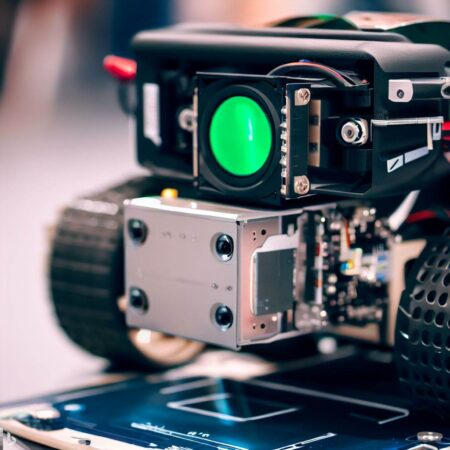

The company attributed its strong guidance to the continued growth of AI applications across various industries and markets, such as healthcare, automotive, robotics, gaming, and entertainment.

Nvidia said that its GPUs and AI chips are powering the AI revolution that is transforming the world with new capabilities and possibilities.

“We had an incredible quarter with record revenue in every segment,”

said Jensen Huang, founder and CEO of Nvidia.

“Our pioneering work in accelerated computing has led to gaming becoming the world’s most popular entertainment, to supercomputing being democratized for all researchers, and to AI emerging as the most important force in technology.”

Nvidia’s earnings report triggered a wave of positive reactions from Wall Street analysts, who praised the company’s dominant position in the AI market and raised their price targets on the stock. Some analysts even predicted that Nvidia could become the first $1 trillion chip stock in the near future.

“Nvidia is on fire,”

said Hans Mosesmann, an analyst at Rosenblatt Securities, who raised his price target on Nvidia from $400 to $600.

“The company is benefiting from secular trends in AI that are reshaping computing as we know it.”

“Nvidia is not just a semiconductor company anymore; it is an AI platform company,”

said Harsh Kumar, an analyst at Piper Sandler, who increased his price target on Nvidia from $360 to $400.

“The company has a clear vision for the future of computing and is executing flawlessly on its strategy.”

“Nvidia is the only arms dealer in the AI war,”

said Patrick Moorhead, an analyst at Moor Insights & Strategy.

“The company has a huge lead over its competitors in terms of technology and innovation.”

Nvidia’s stock performance has been remarkable over the past year, as it has more than tripled its value amid the pandemic-induced surge in demand for digital services and solutions powered by its GPUs and AI chips.

The company has also made several strategic moves to expand its product portfolio and market reach, such as acquiring Arm Holdings for $40 billion, launching new GeForce RTX 30 series GPUs based on its Ampere architecture, and introducing new platforms and software for AI development and deployment.

Nvidia’s stock is currently trading at a price-to-earnings ratio of 218.28, which is significantly higher than the industry average of 35.77.

However, some analysts argue that Nvidia deserves a premium valuation given its strong growth prospects and competitive advantages in the AI market.

“Nvidia is not just another chip stock; it is a unique story that deserves a higher multiple,”

said Mark Lipacis, an analyst at Jefferies, who boosted his price target on Nvidia from $405 to $440.

“The company has created a virtuous cycle of innovation that enables it to capture more value from the AI opportunity than anyone else.”

Source:

- NVIDIA Corporation (NVDA) Stock Price, News, Quote & History – Yahoo.

- NVIDIA Corporation (NVDA) Stock Price & News – Google Finance.

- NVIDIA – 24 Year Stock Price History | NVDA | MacroTrends.

- NVIDIA Stock Forecast, Price & News (NASDAQ:NVDA) – MarketBeat.